Stonewell Bookkeeping Things To Know Before You Buy

Wiki Article

8 Simple Techniques For Stonewell Bookkeeping

Table of ContentsSome Of Stonewell BookkeepingStonewell Bookkeeping - An OverviewThe Ultimate Guide To Stonewell BookkeepingThe Ultimate Guide To Stonewell BookkeepingSome Known Details About Stonewell Bookkeeping

Rather than undergoing a declaring cabinet of various documents, invoices, and receipts, you can present detailed records to your accountant. Consequently, you and your accountant can conserve time. As an included bonus offer, you might even have the ability to recognize potential tax write-offs. After using your audit to file your taxes, the IRS may choose to carry out an audit.

That funding can come in the kind of proprietor's equity, grants, organization lendings, and capitalists. Financiers need to have an excellent concept of your company prior to spending.

The Definitive Guide for Stonewell Bookkeeping

This is not intended as lawful suggestions; to learn more, please go here..

We addressed, "well, in order to understand exactly how much you require to be paying, we require to recognize just how much you're making. What are your profits like? What is your earnings? Are you in any type of financial debt?" There was a long time out. "Well, I have $179,000 in my account, so I presume my net revenue (profits much less expenses) is $18K".

Stonewell Bookkeeping Can Be Fun For Everyone

While maybe that they have $18K in the account (and even that could not be real), your balance in the financial institution does not always establish your home revenue. If a person got a give or a financing, those funds are not taken into consideration earnings. And they would not work into your revenue declaration in identifying your profits.

While maybe that they have $18K in the account (and even that could not be real), your balance in the financial institution does not always establish your home revenue. If a person got a give or a financing, those funds are not taken into consideration earnings. And they would not work into your revenue declaration in identifying your profits.Numerous points that you think are costs and reductions are in fact neither. An appropriate collection of books, and an outsourced bookkeeper that can properly classify those transactions, will certainly aid you identify what your service is really making. Bookkeeping is the process of recording, classifying, and arranging a company's financial deals and tax filings.

An effective company calls for help from specialists. With sensible objectives and an experienced accountant, you can easily attend to challenges and keep those concerns at bay. We dedicate our energy to guaranteeing you have a solid financial structure for growth.

7 Simple Techniques For Stonewell Bookkeeping

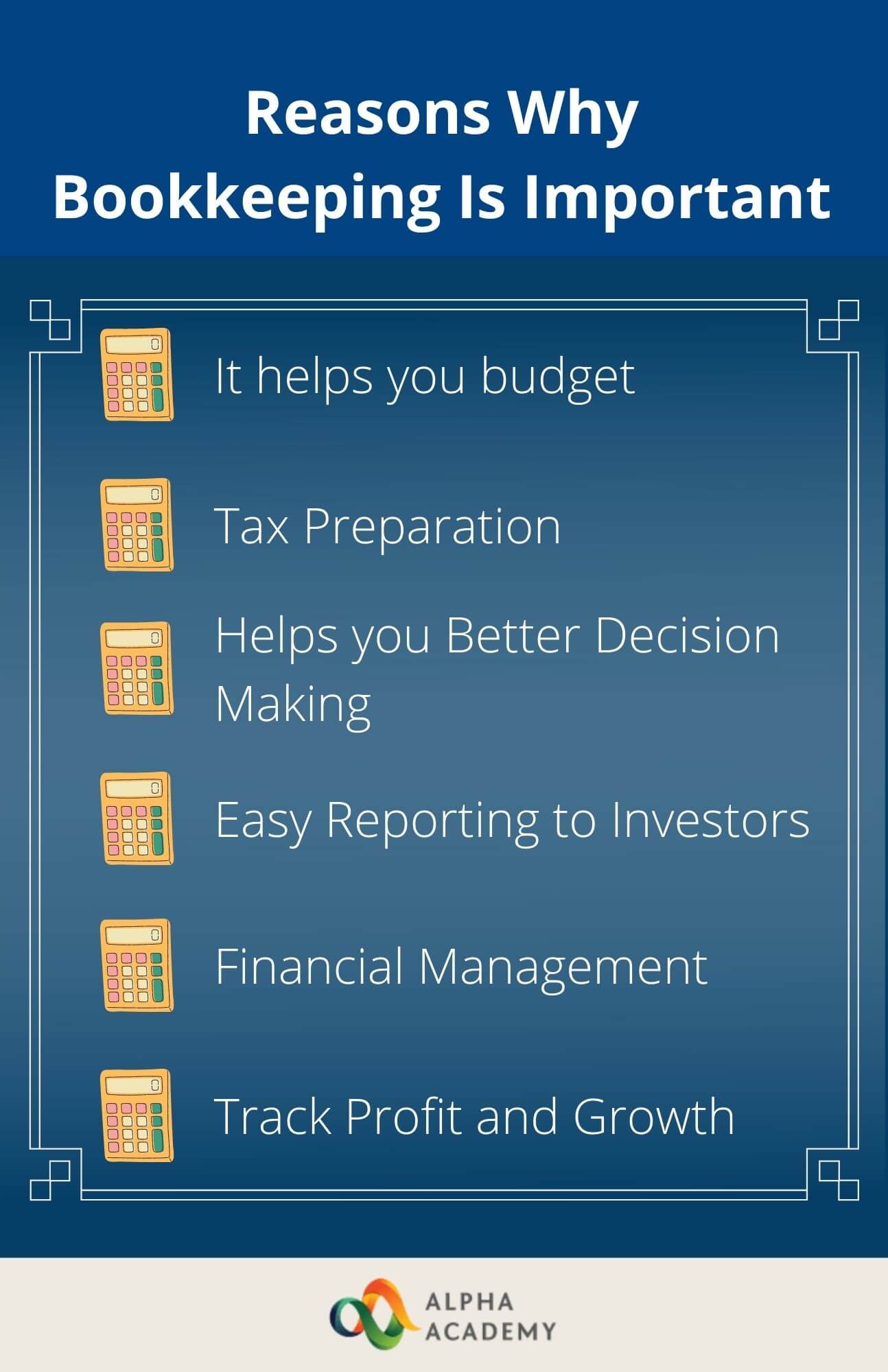

Exact accounting is the backbone of excellent monetary monitoring in any organization. It aids track revenue and expenditures, making certain every deal is recorded effectively. With great bookkeeping, companies can make better decisions due to the fact that clear economic documents supply valuable information that can guide technique and increase profits. This details is key for long-lasting planning and forecasting.Accurate economic declarations construct depend on with lenders and financiers, enhancing your chances of getting the funding you need to grow., organizations need to regularly integrate their accounts.

An accountant will go across bank statements with inner documents at the very least as soon as a month to discover blunders or inconsistencies. Called financial institution reconciliation, this procedure ensures that the monetary records of the company suit those of the financial institution.

Cash Circulation Statements Tracks cash money activity in and out of the business. These records help company owners understand their financial placement and make notified choices.

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

The very best choice relies on your spending plan and business demands. Some small service proprietors choose to deal with bookkeeping themselves utilizing software. While this is cost-efficient, it can be lengthy and susceptible to errors. Devices like copyright, Xero, and FreshBooks enable business proprietors to automate accounting tasks. These programs assist with invoicing, bank reconciliation, and economic coverage.

Report this wiki page